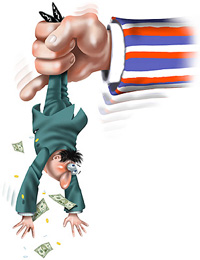

Those nattering nabobs of negativity, the Marin Institute, are gleefully spreading the word that the Governator, Arnold Schwarzenegger, is proposing to raise the tax on beer in order to get California out of the mess that he and the rest of the gang of idiots — collectively known as politicians — got themselves into, dragging us down with them while constantly trying to figure out how to make us pay for their mistakes. So no, I don’t feel too strongly about this issue.

Naturally, they’re characterizing it as a “modest” proposal and continue to justify it with faulty arguments and no understanding of history. But you’ve got to love how they feel about those of us in the beer business. “Despite the whining by industry about a tax increase, the time has come for Big Alcohol to pay its fair share of the cost burden of problem drinking in California. They’ve dodged the bullet for too long.” So I think it’s fair of me to point out that I’ve been quite correct in saying that they’ve been shooting at us, gunning for us, trying to bring us down. They chose the perfect way to phrase that, some old-fashioned honesty for a change. The neo-prohibitionists have been attacking our industry, and we’ve been dodging their bullets. But responding to those premeditated attacks, and trying to defend ourselves, that they consider “whining.” Really? For Schwarzenegger it may be about the money, but for these chuckleheads it’s moral indignation.

So here’s the lie. The neo-prohibitionists talk about how little taxes are paid on beer, as if breweries are getting away with something. Or that it’s the responsibility of alcohol companies to pay for how a minority of drinkers abuse it and exercise incredibly poor judgment. They don’t seem nearly as quick to make gun makers responsible for a crime committed using one of their guns. They’re not suggesting fast food companies be held accountable for their role in creating an obese, unhealthy populace and placing a huge burden on medical facilities. They want beer companies to pay for medical expenses supposedly caused by a minority of their customers abusing alcohol. Please explain to me how that’s different from the health risks posed by fast food, soda, red meat, and all manner of overindulgences? And what industry does the most harm and places the biggest costs on our society? That would be the automotive industry, along with the the related oil interests.

But let’s assume, just for talking about it, that beer should pay those taxes. Le’s get back to that notion that the industry is getting away with something, underpaying our “fair share,” as it were. The state excise taxes that they’re talking about bumping up a nickel, and saying that they haven’t been raised since 1992 is, of course, nowhere near the whole story.

In addition to those taxes, breweries pay many other taxes on the beer you enjoy. It’s not just that one tax. In fact, about 44% of the cost of your beer goes to taxes of one kind or another? That’s nearly half! Here’s a list of many of the taxes that go into that 44%.

Taxes Paid On Beer

- Federal Excise Tax on Beer

- State Excise Tax on Beer

- State Sales Tax on Beer

- State Sales Tax on Federal Excise Tax

- State Sales Tax on State Excise Tax

- County Sales Tax on Beer

- County Sales Tax on Federal Excise Tax

- County Sales Tax on State Excise Tax

- Federal Income Tax

- Federal Payroll Tax

- Workmen’s Compensation Taxes

- Unemployment Insurance Taxes

- State Property Tax

- Local Property Tax

- Federal State and County Gas Taxes

- Tire Excise Tax

- Truck Highway Use Taxes

- Heavy Truck Excise Taxes

- Telephone Excise Tax

- Business License Fees

- State Insurance Premiums Tax

But wait. Don’t other businesses pay all of those taxes, too? Why yes they do, all except the excises taxes, state and federal, and the taxes on the excise taxes. Those are unique to alcohol (and also tobacco) and are, I think, at the heart of what’s wrong with the neo-prohibitionists argument. But I’ll go into that later. For now, what do those additional unique taxes add to what other businesses have to pay in order to do business. “According to a 2005 study by Global Insight and the Parthenon Group, more than 40% of every beer sold in the United States is consumed by taxes. In fact, the total tax burden adds up to nearly 70% more than the average amount of tax paid in the U.S. on all other purchases. That represents well above $10 billion in extra taxes paid on beer.” So much for the beer industry not paying its fair share.

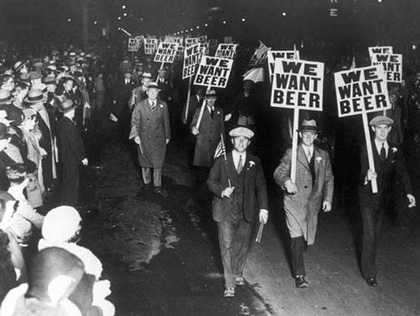

But where did that excise tax come from? Why do brewers pay it now, when no other industry, save tobacco, has to? Well the history of excise taxes stretches back to the Civil War, or War Between the States for my southern readers. During Lincoln’s first term, the North had to raise money to finance the Civil War and they turned to the beer industry, among others, to help finance the war effort.

In Brewing Battles, by Amy Mittleman, she details how in July of 1861, the US Congress (or a least what was left of it in the north) levied the first income tax on the remaining states in order to raise money to fight the war with the southern states. By the end of the year, Congress realized it wasn’t enough and they needed a way to raise more funds for the war. In a special session in December 1861, Congress reviewed a request by the Secretary of the Treasury, Salmon P. Chase, to raise the percentage of income tax slightly and levy excise taxes on a number of goods, including beer, distilled spirits, cotton, tobacco, carriages (the automobiles of the day), yachts, pool tables and even playing cards, to name a few. The amendments passed, and Lincoln signed them into law July 1, 1862. They took effect September 1. Several weeks later, the first trade organization of brewers, the United States Brewers Association (USBA), was founded in New York.

Excise taxes are a “type of tax charged on goods produced within the country (as opposed to customs duties, charged on goods from outside the country).†The excise taxes were intended to be “temporary†but it was the beginning of temperance sentiments in the nation, and many people objected to alcohol on moral grounds. In the decade following the war, most were rescinded, but the taxes on alcohol and tobacco were the only two to remain in force, and in fact are still in effect today.

The only reason these excise taxes remained after the Civil War was primarily on moral grounds, coming from prohibitionist organizations. And I think that’s still relevant in 2008 because today’s neo-prohibitionists are also trying to use a moral sledgehammer to raise taxes on alcohol in an effort to put beer companies out of business and/or bring about another national prohibition. In state legislatures in many states, neo-prohibitionist groups are trying a variety of tactics to further their agenda. Usually it’s couched in propaganda that pretends they’re concerned for the children, or people’s health or some other hollow claim that hides their true aims.

I still find the argument strange that there should be higher taxes on products some people find morally objectionable. I find soda morally objectionable because it’s so unhealthy that it’s contributing to a nation of obese kids (and adults) — not to mention that beer in moderation is much healthier for you. But I wouldn’t argue pop should have an excise tax. The very concept of a so-called “sin†tax seems antithetical to the separation of church and state. Sin is a religious concept, and should play no role whatsoever in our government. Making people pay a higher price for goods that other people don’t like seems not only a little cruel, but also contrary to freedom of religion, because those are the morals people are using to deny people getting (or making prohibitively expensive) certain goods that not everyone agrees are sins. By using one set of morals as the basis for a particular law (in this case an excise tax) it ignores other sets of morals that differ from the prevailing one. That’s how a theocracy works, and we’re not one yet, despite recent efforts to make religion a central issue in government.

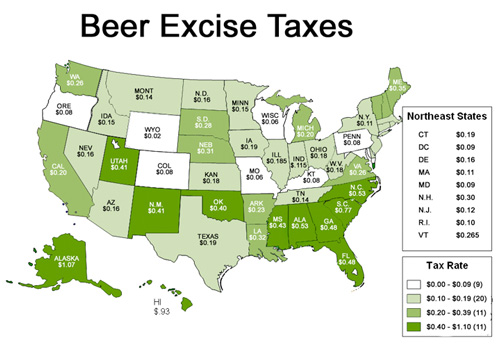

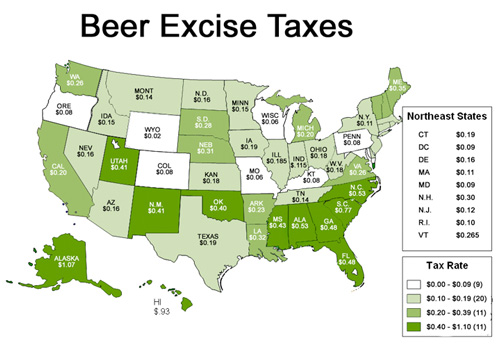

That’s the federal excise tax, and there’s an interesting part of that story, too, which we’ll get to. After Prohibition ended in 1933, most states imposed a new state excise tax as a part of allowing alcohol back into society legally. Today, each state’s excise tax is very different, with Alaska being the highest and Wyoming the lowest. California’s in the middle, tied at 21st (see this chart of State Beer Excise Tax Rates). And it’s that particular tax that California wants to raise a nickel now. So let’s return to the neo-prohibitionist argument that the California excise tax hasn’t been raised since 1991. What they don’t mention is that around the very same time, the tax burden for breweries jumped up considerably, when Congress doubled the federal excise tax in 1991, jumping from $9 per barrel to $18!

Here’s what happened, from Roll Back the Beer Tax:

In 1990, Congress raised taxes on luxury items like expensive cars, fur coats, jewelry, yachts, and private airplanes and doubled the federal excise tax on beer. This was the largest single increase in the tax on beer in American history and resulted in some 60,000 people losing their jobs in brewing, distributing, retailing and related industries.

Today, all of the other luxury taxes have been repealed, but the beer tax remains in place. The tax burden on beer is far higher than the average consumer good in the American economy. Astonishingly, over 40% of the cost of every beer sold is comprised of taxes. This means working Americans continue to reach into their pockets to pay the beer tax … at the rate of $5.2 billion a year.

And here’s why excise taxes are such a bad deal for the economy:

A tax is considered regressive if it falls more heavily on lower- and middle-income families than on the wealthy. And this is certainly true with beer taxes. This has long been recognized, but perhaps underappreciated. Analyses based on recent data from the Consumer Expenditure Survey clearly show that beer taxes are very regressive, as a percentage of income, costing lower- and middle-income households many times more than those with more comfortable incomes. A recent Beer Institute analysis found that beer taxes are actually 6.5 times higher as a percent of income for lower-income households (those earning less than $20,000 per year) compared to higher-income households (earning $70,000+ per year). As a result, the tax on beer is one of the most regressive of all taxes in the federal and states’ tax codes.

Viewed another way, 50% of all beer, is purchased by families with incomes of $50,000 or less, though these households account for less than one-fourth of all income earned in the U.S.

Sadly, the fact that beer taxes are very regressive has been known for quite some time, yet they continue to persist. A strong case can be made for rolling back or reducing beer taxes, based on the simple fact that research has exposed – notably, by Citizens for Tax Justice (CTJ) and the Institute on Taxation and Economic Policy (ITEP) – that the overall tax systems in many cases are already disturbingly regressive with many becoming decidedly more regressive in the past decade or more. According to the report, “sales and excise taxes are the most regressive element in most state and local tax systems.”

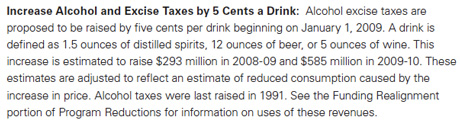

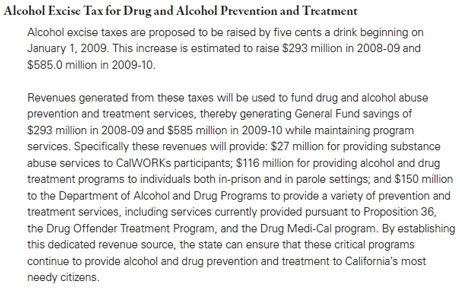

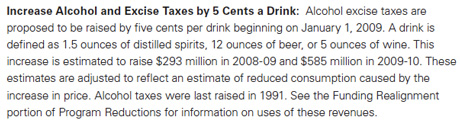

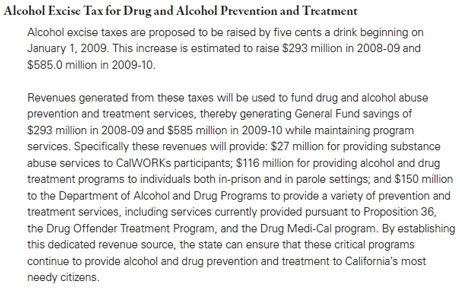

But let’s get back to California’s proposal. Here’s the language from the budget proposal (it’s an image because the pdf is locked for copying the text. If you have trouble reading this, download the original pdf for the Budget Proposal):

So let’s go the Funding Realignment, as they suggest. This is undoubtedly what the Marin Institute is crowing about when they say revenues from the new tax will be “providing critical support to programs that deal specifically with alcohol-related problems.”

But take a closer look at that language. What is says is that “[r]evenues generated from these taxes will be used to fund drug and alcohol abuse prevention and treatment services.” [my emphasis.] Hmm, why is the brewing industry also funding drug abusers? The argument being advanced to justify all of this is that beer industry is supposed to fund the problems neo-prohibitionists insist they created. Well, I’m pretty sure you can’t pin that on the monkey on your back, that “H” problem or your crack addiction on beer. Even using their own logic, such as it is, that seems incredibly unfair.

This isn’t the first time, even recently, that beer has been tapped to fix budget problems not of their making. For the morally indignant, it apparently fits some weird moral compass to punish an industry they don’t agree with in order to to fix the shortcomings of our politicians. Earlier this year, state congressman Jim Beall proposed raising beer taxes 1400% for “health reasons” and in June the Sacramento Bee weighed in with their own nonsensical proposal, though that time the bogeyman was specifically alcopops.

The idea that beer drinkers should have to pay for our state’s fiscal irresponsibility is so ridiculous that I’m amazed the argument can be made with a straight face. But that’s what many have proposed, in effect, the Sacramento Bee weighed in with their own absurd idea, that goes like this: “Psst! Hey, legislators — looking for some fast cash to ease the budget crisis? Think booze.†The faulty logic, downright incorrect statements and tortured reasoning are in virtually every sentence. It’s as if up really were down in the Bee’s worldview.

The Marin Institute, an alcohol industry watch group [who originally floated this idea], estimates that raising taxes on all alcoholic beverages just 25 cents per drink would raise $3 billion. That’s money the state desperately needs from an industry that has not paid its fair share for a long, long time.

As a colleague of mine put it, “saying the Marin Institute is “an alcohol industry watch group†is like saying the Taliban is a cultural and morality watch group.†The Marin Institute is nothing so grand. They are quite simply a neo-prohibitionist group who wants to return to a time when all alcohol is illegal and they will use any means necessary to achieve that goal. But that aside, saying that taxes should be raised because “the state desperately needs†it is not a valid reason. It may be a result, but what kind of world would we have if every time we needed money, our government looked around for somebody they didn’t like and decided to target them for higher taxes. That’s not a world I’d want to live in. That’s certainly not the high-minded ideals we should be aspiring to.

Where the taxes on any good or product made should be a policy decision based on a variety of factors, none of which should include manufactured hysteria, the agenda of a misinformed and misguided minority, or an opinion based on a lack of truthiness by an apparently biased newspaper.

So no matter how you look at this, it just makes no sense, has no internal logic, and just feel like as an industry we’re being attacked once again. Apart from raising the tax on oil found in California and the sales tax on certain goods that weren’t subject to it in the past — like appliance and furniture repair, automotive repair, amusement parks, sporting events and veterinarians — beer has been singled out for special assessment again. That so many feel that it’s fair to do so, I find remarkable, especially since proponents do not see how they’re using morality to solve political problems. But perhaps they do know full well what they’re doing but just don’t care about fairness. What’s important is their agenda, and the real consequences to those who disagree with them are inconsequential. I sometimes feel like they don’t consider their opponents — you and me — as fully human. Or perhaps they see us as children who need their moral guidance, though meted out with a bludgeon — tough love indeed.

From a purely pragmatic position, placing a burden on a not insignificant part of the state’s economy seems misguided at best. Of California’s $1.6 trillion economy, the beer industry represents $24,646,539,216 or just over 1.5%. In difficult economic times, why would you try to harm such a large percentage of it? For those of us who can look past the moral arguments, it feels a little like shooting oneself in the foot.

The Marin Institute doesn’t see that, of course, and wants to shoot everybody in the foot. They claim “[a]t least 38 other states also face serious budget deficits, totaling more than $60 billion dollars, according to the Center on Budget and Policy Priorities. ‘A nickel a drink — It’s the change we need to fix budgets around the nation,’ said Bruce Lee Livingston, executive director of Marin Institute, the California-based alcohol industry watchdog. ‘The largest states, such as New York and Florida can avoid cutting essential programs through long-overdue alcohol tax increases,’ Livingston added. California’s proposal accomplishes exactly that.” Don’t you believe it. The California budget deficit is $11.2 billion. The Governor’s proposal estimates raising only $293 million from the beer industry. That comes nowhere close to “fixing” our budget, and simply unfairly harms an industry already struggling to recover from record increases of crucial ingredients, like hops and malt.

There’s no doubt we need to fix the budget deficit gripping California, and in the many other states where it’s an issue. And let’s not forget the record federal deficit that eight years of Republican neocon rule have run up, the same folks in favor of us returning us to a national prohibition. As of this morning, it was $10,636,486,383,932.04. According to the U.S. National Debt Clock, the “estimated population of the United States is 305,064,289 so each citizen’s share of this debt is $34,866.38. The National Debt has continued to increase an average of $3.99 billion per day since September 28, 2007!” Our economy is obviously in serious jeopardy. But this is a problem that affects us all equally, and any solutions should likewise be distributed evenly among the citizenry. Any other result is simply patently unfair.